When you’re diving into the world of finance and looking for top-notch training, the decision between CFI (Corporate Finance Institute) and Wall Street Prep can feel a bit overwhelming. Both offer popular financial modeling courses, but they cater to slightly different audiences and learning styles.

I’ve had a chance to explore both, and from my experience, CFI tends to offer a more structured learning path with a wide range of courses, ideal if you’re looking for flexibility.

On the other hand, Wall Street Prep is known for its practical, hands-on approach, especially if you’re eyeing investment banking or private equity.

In this comparison, I’ll break down the strengths of each so you can make an informed choice based on what suits your career goals and learning preferences best. Let’s dive in!

CFI Overview

The Corporate Finance Institute (CFI) is a leading global provider of online financial education and certification programs.

Renowned for its practical, industry-focused courses, CFI equips professionals with essential skills in financial modeling, valuation, corporate finance, investment analysis, and more.

Its programs, including the Financial Modeling and Valuation Analyst (FMVA®) certification, are designed by experts to bridge the gap between academic theory and real-world application.

With self-paced learning, interactive exercises, and comprehensive resources, CFI empowers individuals to excel in finance careers.

Trusted by thousands of professionals and companies worldwide, CFI fosters growth and career advancement in the competitive finance industry.

Wall Street Prep

Wall Street Prep is a leading provider of financial training and professional development programs, specializing in investment banking, private equity, corporate finance, and financial modeling.

Their courses offer hands-on learning, focusing on real-world applications of financial concepts, including financial statement analysis, valuation techniques, and Excel modeling.

Aimed at finance professionals and students, Wall Street Prep provides both in-person and online training options, catering to various skill levels.

The company’s programs are widely recognized in the finance industry and help participants prepare for demanding roles, particularly in investment banking and other financial services sectors.

Features Comparison: CFI vs Wall Street Prep

1. Course Offerings:

CFI: Offers a broad range of online courses focused on financial modeling, valuation, accounting, and corporate finance. Includes certifications like FMVA (Financial Modeling & Valuation Analyst).

Wall Street Prep: Primarily focused on investment banking, private equity, and financial modeling. Known for practical, hands-on Excel training and real-world case studies.

2. Delivery Method:

CFI: Fully online with on-demand courses, and offers self-paced learning, which can be convenient for busy professionals.

Wall Street Prep: Offers both in-person and online courses. In-person training is more intensive, typically used by universities and investment firms for group training.

3. Course Content:

CFI: Comprehensive courses on financial modeling, valuation, Excel, accounting, and more. They emphasize theory along with application.

Wall Street Prep: Focuses heavily on practical application and real-world scenarios, particularly in financial modeling, valuation, and Excel. Courses are designed for high-level investment banking training.

4. Certification:

CFI: Offers the FMVA certification, which is recognized by finance professionals and companies.

Wall Street Prep: Does not provide a formal certification program but offers completion certificates for courses. Training is widely respected in the finance industry.

5. Target Audience:

CFI: Aimed at a broad audience, including students, professionals, and career changers in various finance sectors.

Wall Street Prep: Primarily targets investment bankers, private equity professionals, and those looking to enter high-level finance roles.

6. Strengths:

CFI: Great for foundational learning, flexibility, and the FMVA certification.

Wall Street Prep: Best known for hands-on, practical financial modeling training, especially for those pursuing investment banking or private equity.

7. Reputation:

CFI: Widely respected in the finance community for its comprehensive online training.

Wall Street Prep: Highly respected in the investment banking sector, with a strong reputation for producing candidates who are job-ready.

Verdict:

CFI may be a better choice if you’re looking for a comprehensive, cost-effective, and well-recognized certification in financial modeling and corporate finance.

Wall Street Prep, while strong in advanced, niche finance training (particularly for investment banking), may appeal more to those with specific, high-level career goals in those fields.

Pricing Comparison: CFI vs Wall Street Prep

CFI Pricing

The Corporate Finance Institute (CFI) offers various subscription plans tailored to individual learners and organizations, providing comprehensive access to their finance and banking training resources.

1. Individual Learners

- Self-Study (All Access):

Priced at $497 annually, this plan provides unlimited access to over 200 on-demand courses, 5,000+ video lessons, six accredited certification programs—including the Financial Modeling & Valuation Analyst (FMVA®) and Commercial Banking & Credit Analyst (CBCA®)—11 skill-focused specializations, and a library of downloadable financial models and templates. Learners can also earn over 300 CPE/CPD credits recognized by leading accounting and finance institutions.

- Full-Immersion (Premium Access):

At $847 per year, this plan includes all the features of the Self-Study subscription, plus additional benefits such as a course-integrated AI chatbot offering support in over 25 languages, up to five one-on-one “Ask-an-Expert” guidance sessions per week with curriculum specialists, personalized financial model feedback (one per week), premium downloadable templates, and exclusive offers from partners like Capital IQ and IBISWorld.

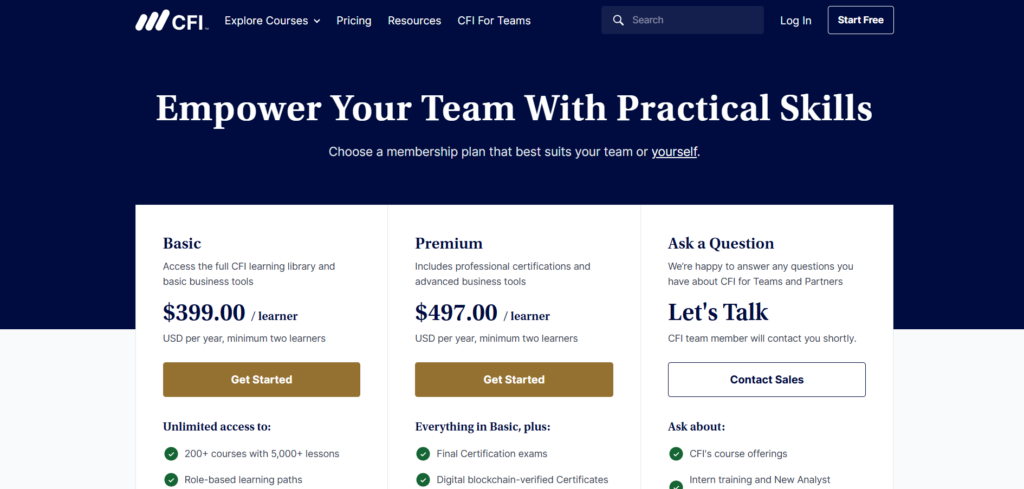

2. CFI for Teams

- Basic:

At $399 per learner annually (with a minimum of two learners), this plan offers unlimited access to the full CFI learning library, role-based learning paths, the ability to create and assign customized learning paths, a management dashboard with reporting capabilities, and premium email support.

- Premium:

For $497 per learner per year (minimum two learners), this plan encompasses all Basic features and adds access to final certification exams, digital blockchain-verified certificates, and advanced business tools.

Please note that all prices are in USD and billed annually. CFI occasionally offers promotional discounts; it’s advisable to check their official website for the most current pricing.

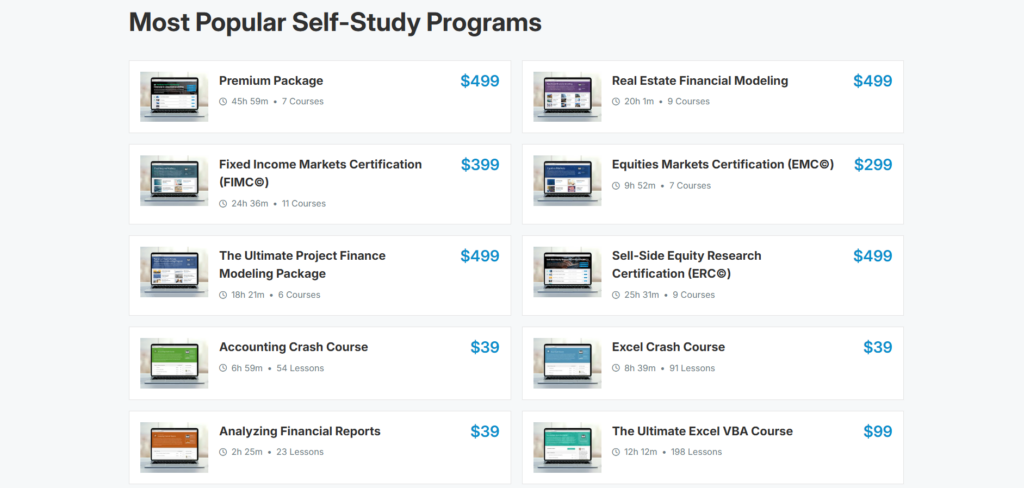

Wall Street Prep Pricing

1. Financial Modeling & Valuation (Self-paced online courses):

- Prices typically range from $499 to $1,500, depending on the package and course complexity.

- For example, the Financial Modeling Self-Study Package costs around $499, while more advanced packages such as Investment Banking or Private Equity training courses can cost up to $1,500.

2. Bootcamps/Live Seminars:

Wall Street Prep offers live workshops and bootcamps (both in-person and virtual) that can cost upwards of $2,000 – $3,000 per program. These live programs are usually more expensive due to personalized interaction and advanced material.

Discounts: Wall Street Prep often offers promotions and discounts, but their pricing can still be relatively high, especially when considering the cost of live events.

Verdict:

CFI is generally the better choice for most people, especially when considering overall cost-effectiveness. It provides a wide variety of well-structured, affordable courses, including industry-recognized certifications (FMVA), at a more reasonable price point.

Wall Street Prep, while offering high-level, niche training (particularly for investment banking), can be more expensive, especially for live events or highly specialized courses.

Therefore, CFI stands out as the better option in terms of pricing for individuals looking for a comprehensive, cost-effective learning experience.

Customer Support: CFI vs Wall Street Prep

CFI (Corporate Finance Institute) offers superior customer support compared to Wall Street Prep, with multiple channels like email, live chat, and a detailed knowledge base.

CFI’s standout feature is personalized instructor support available in Pro and Complete packages, allowing learners to resolve complex queries with expert guidance.

It also provides an active online community for peer interaction, enhancing the learning experience. In contrast, Wall Street Prep’s support focuses on email and occasional live chat, with direct instructor interaction mainly for premium workshops.

CFI’s faster response times, accessible resources, and learner-focused approach make it a better choice for comprehensive support.

The Final Verdict

CFI (Corporate Finance Institute) is the better choice over Wall Street Prep for most learners due to its affordability, broader course offerings, and industry-recognized certifications like the FMVA.

CFI provides lifetime access to materials, flexible self-paced learning, and robust support, including live chat, instructor guidance, and a vibrant online community.

While Wall Street Prep excels in niche, advanced finance topics like private equity and M&A, its courses are costlier and lack a widely recognized certification equivalent to FMVA.

With superior value, accessible pricing, and comprehensive customer support, CFI is ideal for learners seeking well-rounded financial training and credentials.

FAQ’s

Which is more affordable?

CFI is more affordable with budget-friendly subscription options and lifetime access.

Which offers better certifications?

CFI’s FMVA certification is widely recognized and adds strong value to resumes.

Which has more diverse course offerings?

CFI offers a broader range of topics, covering financial modeling, Excel, and corporate finance.

Which has better customer support?

CFI offers faster response times, live chat, and personalized instructor support.

Which is better for self-paced learning?

CFI provides more flexible, structured self-paced learning options.