When it comes to online learning platforms, CFI (Corporate Finance Institute) and Coursera are two popular choices, but they serve slightly different needs. I’ve used both, and while they offer great courses, their focus is distinct.

CFI is perfect if you’re looking to specialize in finance, offering highly focused, career-oriented programs, particularly for those pursuing financial certifications like FMVA.

The courses are built with professionals in mind, and they give a deep dive into financial modeling, analysis, and other niche topics.

On the other hand, Coursera is broader, offering a wide range of courses across many fields, from tech to business to humanities. It partners with top universities and companies, giving you a chance to earn certificates from well-known institutions.

Choosing between the two depends on your goals—CFI for finance-focused skills, or Coursera for a wider variety of subjects and certifications.

CFI Overview

The Corporate Finance Institute (CFI) is a leading global provider of online financial education and certification programs.

Renowned for its practical, industry-focused courses, CFI equips professionals with essential skills in financial modeling, valuation, corporate finance, investment analysis, and more.

Its programs, including the Financial Modeling and Valuation Analyst (FMVA®) certification, are designed by experts to bridge the gap between academic theory and real-world application.

With self-paced learning, interactive exercises, and comprehensive resources, CFI empowers individuals to excel in finance careers.

Trusted by thousands of professionals and companies worldwide, CFI fosters growth and career advancement in the competitive finance industry.

Coursera

Coursera is an online learning platform offering courses, specializations, and degrees across various fields, in partnership with top universities and organizations.

It provides flexible, accessible education in subjects like business, technology, health, and humanities. Learners can choose from free or paid courses, many of which are taught by university professors and industry experts.

Coursera’s offerings include certifications, professional development programs, and fully accredited degrees.

The platform aims to make high-quality education accessible to learners worldwide, helping them build skills, earn credentials, and advance their careers. It also features interactive elements like quizzes and peer assessments.

Key Features Comparison: CFI vs Coursera

CFI (Corporate Finance Institute) and Coursera are both popular online learning platforms, but they serve different niches and offer distinct features. Here’s a key comparison of their features:

1. Course Focus

CFI: Specializes in finance, accounting, financial modeling, and business-related courses. It’s tailored to professionals looking to improve skills in corporate finance, investment banking, and financial analysis.

Coursera: Offers a much broader range of courses across diverse fields like business, technology, data science, arts, humanities, and more. It partners with top universities and organizations for a wide array of subjects.

2. Course Structure

CFI: Primarily offers self-paced learning with a focus on practical, industry-specific skills like financial modeling and valuation. Includes certifications such as the FMVA (Financial Modeling & Valuation Analyst).

Coursera: Provides courses, specializations, professional certificates, and full degrees. Many of its courses are taught by university professors, offering more traditional academic content with a mix of video lectures, assignments, and peer discussions.

3. Certificates and Degrees

CFI: Offers professional certifications like FMVA, CBCA (Certified Business Contract Advisor), and advanced financial modeling programs. These are designed for career advancement in finance roles.

Coursera: Offers certificates for individual courses, specialization programs, and full university degrees (undergraduate and graduate). These can be more recognized in academic or professional contexts.

4. Learning Format

CFI: Focuses on a practical, hands-on approach with case studies, templates, and tools useful for finance professionals. There’s a heavy emphasis on applied knowledge.

Coursera: Offers more diverse learning formats, including video lectures, assignments, quizzes, peer-reviewed projects, and some interactive elements like discussions or capstone projects.

5. Pricing

CFI: Offers individual course purchases and a subscription model for access to multiple courses. The FMVA certification is a paid program with a fixed price.

Coursera: Offers a combination of free courses, paid courses, and subscription-based programs. Specializations and degrees come with a monthly fee or one-time tuition, often with financial aid available.

6. Target Audience

CFI: Geared toward professionals in finance and accounting, especially those in roles like financial analysts, investment bankers, or corporate finance managers.

Coursera: Targets a broader audience, from beginners to advanced learners, across various fields. It’s ideal for both personal development and academic pathways.

7. Industry Recognition

CFI: Highly recognized in the finance industry, especially for financial modeling certifications. It’s well-regarded by employers in the corporate finance and investment banking sectors.

Coursera: Offers more varied recognition depending on the course or degree, but its partnerships with top universities (like Stanford, Yale, and others) give its credentials significant academic and professional weight.

8. Accreditation

CFI: While CFI offers industry-recognized certifications, it does not provide traditional academic accreditation.

Coursera: Provides accredited degrees and certificates in collaboration with universities, offering more formal academic recognition.

9. Interactive Features

CFI: Features practical exercises, downloadable templates, and real-world financial case studies to reinforce learning.

Coursera: Offers a mix of interactive features, such as quizzes, peer reviews, group projects, and online forums to foster engagement.

10. Global Reach

CFI: Primarily focused on professionals in finance globally, particularly those in the corporate and investment banking sectors.

Coursera: Serves a global audience with a wide variety of subjects and courses accessible to learners from all over the world.

Conclusion: Why CFI Might Be the Better Choice for Finance Professionals

If your career path is in corporate finance, investment banking, or financial analysis, CFI is likely the better option due to its specialized, practical content tailored for finance professionals.

The FMVA certification is a valuable credential for career advancement, offering real-world tools and techniques directly applicable to finance jobs.

Pricing Comparison: CFI vs Coursera

CFI Pricing

The Corporate Finance Institute (CFI) offers various subscription plans tailored to individual learners and organizations, providing comprehensive access to their finance and banking training resources.

1. Individual Learners

- Self-Study (All Access):

Priced at $497 annually, this plan provides unlimited access to over 200 on-demand courses, 5,000+ video lessons, six accredited certification programs—including the Financial Modeling & Valuation Analyst (FMVA®) and Commercial Banking & Credit Analyst (CBCA®)—11 skill-focused specializations, and a library of downloadable financial models and templates. Learners can also earn over 300 CPE/CPD credits recognized by leading accounting and finance institutions.

- Full-Immersion (Premium Access):

At $847 per year, this plan includes all the features of the Self-Study subscription, plus additional benefits such as a course-integrated AI chatbot offering support in over 25 languages, up to five one-on-one “Ask-an-Expert” guidance sessions per week with curriculum specialists, personalized financial model feedback (one per week), premium downloadable templates, and exclusive offers from partners like Capital IQ and IBISWorld.

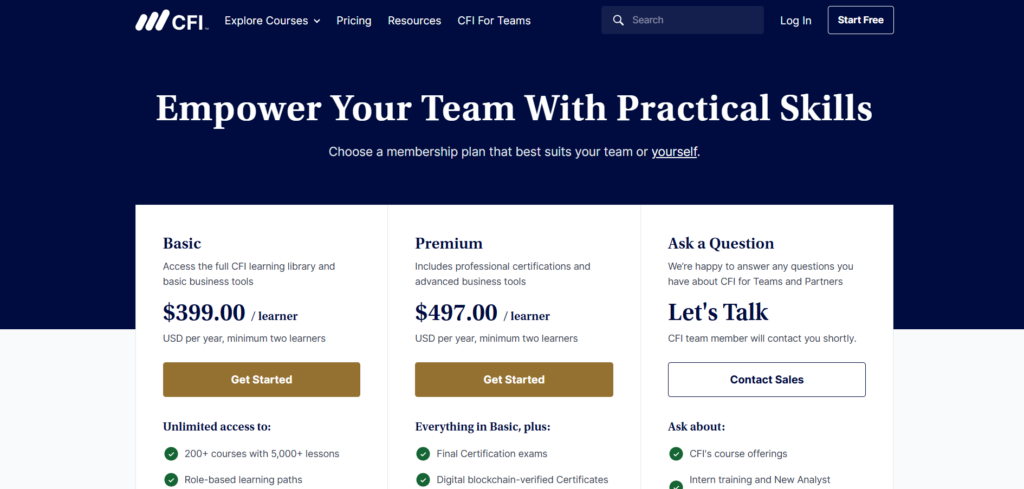

2. CFI for Teams

- Basic:

At $399 per learner annually (with a minimum of two learners), this plan offers unlimited access to the full CFI learning library, role-based learning paths, the ability to create and assign customized learning paths, a management dashboard with reporting capabilities, and premium email support.

- Premium:

For $497 per learner per year (minimum two learners), this plan encompasses all Basic features and adds access to final certification exams, digital blockchain-verified certificates, and advanced business tools.

Please note that all prices are in USD and billed annually. CFI occasionally offers promotional discounts; it’s advisable to check their official website for the most current pricing.

Coursera Pricing

Coursera offers a wide range of courses across various subjects, including degrees, specializations, and individual courses. Their pricing is more varied due to the broad spectrum of content they provide.

1. Individual Courses:

- Cost: Typically ranges from $29 to $99 per course.

- Some individual courses can be accessed for free (audit option), but the certificate and access to assignments typically cost $29 to $49 per month for most courses.

- Example: A course on financial management or Excel for business might cost around $49 to $99.

2. Specializations:

- Cost: A Coursera Specialization (a series of related courses) typically costs around $39 to $79 per month.

- Example: A financial accounting specialization could take several months to complete, with the price being based on the monthly subscription fee.

3. Professional Certificates:

- Cost: Professional certificates on Coursera generally range from $39 to $79 per month, depending on the program and duration. These programs typically offer certifications that are designed to help learners gain skills for specific careers.

- Examples: Google IT Support or IBM Data Science programs cost about $39 per month.

4. Degree Programs:

- Cost: Coursera offers full online degrees in partnership with universities, such as bachelor’s or master’s degrees.

- Example:

- Master’s Degrees typically range from $15,000 to $40,000 depending on the university and program.

- Bachelor’s Degrees are more expensive and can cost anywhere from $10,000 to $25,000.

- These degree programs are accredited by universities and can take from 1 to 3 years to complete.

5. Coursera Plus Subscription:

- Cost: Coursera offers a subscription plan called Coursera Plus, which provides access to over 7,000 courses for a flat fee of $399 per year.

- With Coursera Plus, you get access to many courses across various subjects and can earn certificates on most courses within the subscription.

6. Free Audits:

Many Coursera courses are available for free if you choose the audit option, where you can access video lectures and some materials but will not receive a certificate. If you want a certificate of completion, you need to pay the fee.

Conclusion: Why CFI Might Be the Better Choice for Finance Professionals

CFI offers specialized finance certifications like the FMVA, priced between $497–$847, with annual subscriptions at $349, providing focused, practical content for finance professionals. In contrast, Coursera has broader course offerings but costs $39–$79/month for specializations and $15,000–$40,000 for degrees.

CFI is more cost-effective for targeted finance career growth, offering industry-recognized certifications and hands-on tools.

Coursera, while versatile, is pricier and less specialized in finance, making CFI the better choice for finance-focused professionals seeking impactful learning.

The Final Verdict

CFI is the superior choice for finance professionals due to its specialized focus, practical tools, and industry-recognized certifications like the FMVA.

With affordable pricing ($497–$847 for certifications or $349/year for subscriptions), CFI delivers job-ready skills tailored to corporate finance, investment banking, and financial modeling.

Coursera, while broader in scope and offering accredited degrees, is more expensive ($15,000+ for degrees) and less focused on finance. For targeted, cost-effective career advancement in finance, CFI is the better option.

FAQ’s

What is CFI best for?

CFI specializes in finance, financial modeling, and industry-recognized certifications like FMVA.

What is Coursera best for?

Coursera offers a wide variety of courses across multiple disciplines, including degrees from top universities.

Which platform is more affordable?

CFI is more affordable for finance-specific certifications, while Coursera’s degrees and specializations are pricier.

Does CFI offer free courses?

No, CFI primarily offers paid courses and certifications.

Which is better for finance professionals?

CFI is better due to its specialized focus and practical, finance-specific training.